“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett

The Day I Discovered the Magic of Compound Interest

As a kid I was obsessed by the thought of becoming a millionaire. I wanted to know: what would it actually take to save a million dollars?

Armed with a piece of paper and a chewed up pencil, I sat down and figured it out.

With some simple math, I realized that if I saved $20,000 a year, it would take me 50 years to reach $1,000,000. I remember thinking, “That’s a lot of money to save—and 50 years? That’s forever!”

But then something amazing happened. I stumbled upon an investment nerds favourite tool: an online compound interest calculator.

Enter the World of Compound Interest

Armed with this exciting new tool I wanted to figure out what the possibilities were with investing? What would I need to invest per month to hit $1 million?

Curious, I started punching in different combinations to the calculator using the following assumptions:

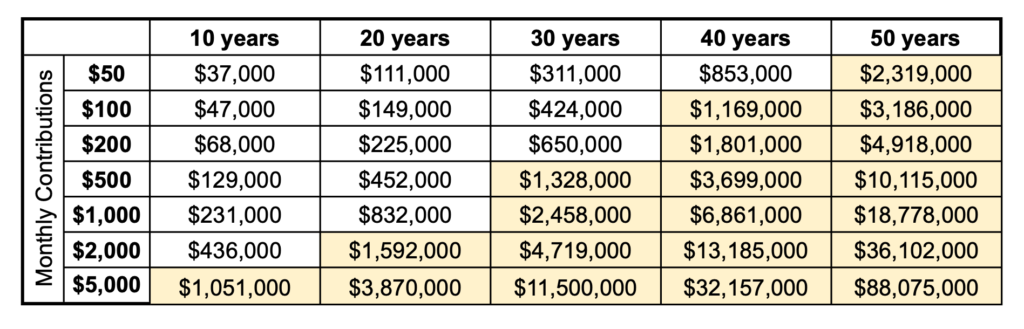

I clicked enter on the calculator and here were my results:

As shown in the table above, every highlighted value surpasses the million-dollar marker.

The table is easy to reference—take this example: if you’re 30 years old, invest $200 per month, and start with an initial $10,000 investment, by the time you reach retirement (age ~70), your total could grow to nearly $2 million!

To explore your own potential results, you can use one of the many online compound interest calculators available, like this one: Compound Interest Calculator

With that calculator I learned about the magic of compound interest—how a small consistent investment could snowball into an unbelievable sum over time.

Where to Invest?

You might be wondering, how can I achieve a decent investment return?

The options are vast, but without a doubt, the simplest and most proven method is investing in the stock market.

I’ll dive deeper into the pros, cons, and details of these ETF funds in a future article. In the meantime, there’s no shortage of videos and articles online to help you explore low cost index ETF’s.

The Secret Sauce of Compound Interest

The most important factor in maximizing the benefits of compound interest is time. Even with a moderate investment return, it can grow significantly over the long haul.

It’s never too late to start. Start as soon as possible and watch as your money earns money, and then that money earns even more money (referred to as the snowball effect).

Warren Buffett: The Ultimate Case Study

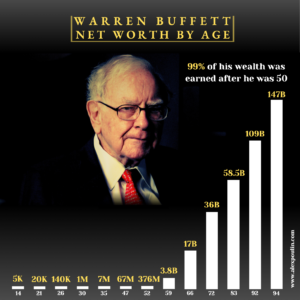

Warren Buffett is the ultimate example of the “snowball effect” in action. The vast majority of his wealth came after age 50, thanks to decades of letting his investments compound.

Warren Buffett minimizes costs through infrequent trading which reduces transaction costs and defers capital gains taxes.

His “buy and hold” strategy focuses on acquiring quality businesses and holding them long-term, allowing investments to grow and compound with minimal interference.

Dreaming Big: The $100 Million Challenge

For fun, I wondered what it would take to grow $100 million in 50 years. Here’s what I found:

- At 8% return: You’d need to invest $160,000 annually.

- At 9% return: It drops to $112,000 annually.

- At 10% return: Now it’s $78,000 annually.

- At 15% return: Just $12,000 annually!

What’s shocking is how a higher rate of return makes such a massive difference. By boosting returns from 8% to 15%, the required annual investment plummets from $160,000 to $12,000. That’s just astounding to me.

This is the true power of compound interest—it thrives on time, but it also loves higher returns.

A Useful Tool: Rule of 72

The Rule of 72 is a quick way to estimate how long it will take for your money to double with compound interest.

Just divide 72 by your expected annual rate of return. It’s a quick and handy tool to visualize the power of compounding.